what percent of taxes are taken out of paycheck in indiana

A 2020 or later W4 is required for all new employees. In other words for every 100 you earn you actually receive 6760.

Tax Withholding For Pensions And Social Security Sensible Money

Each employer withholds 62 of your gross income for Social Security up to income of 132900 for 2019.

. Actually you pay only 10 on the first 9950. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. For 2021 employees will pay 62 in Social Security on the first 142800 of wages.

Switch to Indiana salary calculator. Everything You Need To Know About Taxes This Year Rich Dad Poor Dad Author Robert Kiyosaki. 0495 for tax years ending on or after December 31 2020.

If you had 50000 of taxable income youd pay 10. Effective for tax years ending on or after December 31 2020 the personal exemption amount is 2325. With every paycheck or in one lump sum during tax season.

Earned income income you receive from your job s is measured against seven tax brackets ranging from 10 to 37. Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes. Amount taken out of an average biweekly paycheck.

In most counties you are safe if you have 5 withheld for state tax based on a county tax rate of 15 or less. All these things can be adjusted for your circumstances. The other 3240 is taken out of your paycheck for taxes and other deductions such as health insurance and retirement savings.

A complete list of Indiana county tax rates can be found at httpswwwingovdorfilesdn01pdf. Unlike the federal income tax system rates do not vary based on income level. This Indiana hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Will I have to pay taxes on my prize. What Small Business Owners Need To Know For Payroll. Under IRS rules federal withholding is based on marital status and the number of allowances you claim when you make your federal income tax election.

Indiana Hourly Paycheck Calculator. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. But on top of state income taxes each county charges its own income tax.

Its a flat tax rate of 323 that every employee pays. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. At the time of publication the employee portion of the Social Security tax is assessed at 62 percent of gross wages while the Medicare tax is assessed at 145 percent.

The State of Indiana website posted a complete list of. What percentage of your pay is taken out for taxes. If you earn at least a specified amount for at least 40 quarters you can get Social Security benefits when you retire.

19 Votes Your withholding on a lump sum severance payment will be at a flat rate of 22 percent. Effective January 1 2017 the state tax rate in. The bracket you land in depends on a variety of factors ranging from your total income your total adjusted income filing jointly or as an individual dependents deductions credits and so on.

Total income taxes paid. What if Im part of a group of winners. You may want to consult with a tax advisor to determine whether you will owe any additional taxes.

If you receive severance pay bonuses and other supplemental income in excess of 1 million tax will be withheld at a. However there are some counties that have a higher county tax rates. As an independent contractor that makes more than 600 youll be given a 1099-MISC to file.

It is not a substitute for the advice of an accountant or other tax professional. A lot of independent contractors are not. These amounts are paid by both employees and employers.

You pay 12 on the rest. As a 1099 worker you are solely responsible for handling your taxes use our 1099 calculator to see how much you owe. This gives you your take home pay as a percentage of gross pay per pay period.

You Should Never Say I Cant Afford That. The difference between claiming 1 and 0 on your taxes will determine when you will be getting the most money. If you did not make any election per IRS guidelines you would have defaulted to married with three exemptions.

Amount taken out of an average biweekly paycheck. And some things are taken out as a straight percentage up to a certain amount of income being earned in a year and then stop like FICA. Where Do Americans Get Their Financial Advice.

Look at the tax brackets above to see the breakout Example 2. Indiana Income Taxes. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Each allowance you claim lowers the income subject to withholding. Both taxes combine for a. If you worked for a company your employer typically takes money out from your paycheck to set aside for your taxes owed.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. FICA taxes consist of Social Security and Medicare taxes. 455 177 Views.

The Hoosier Lottery withholds 24 percent in federal tax if the winnings minus the wager are more than 5000 and 323 percent in state tax on any winnings that exceed 1200. Amount taken out of an average biweekly paycheck. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Indiana residents only.

And 137700 for 2020Your employer must pay 62 for you that doesnt come out of your pay. The Indiana bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The income tax rate remains at 495 percent.

Indiana state income taxes are pretty straightforward. Rates do increase however based on geography. The Medicare tax rate is 145.

Your withholding amount is based on the federal tax election you filed with us.

Which States Pay The Most Federal Taxes Moneyrates

Indiana Income Tax Calculator Smartasset

Indiana Paycheck Calculator Smartasset

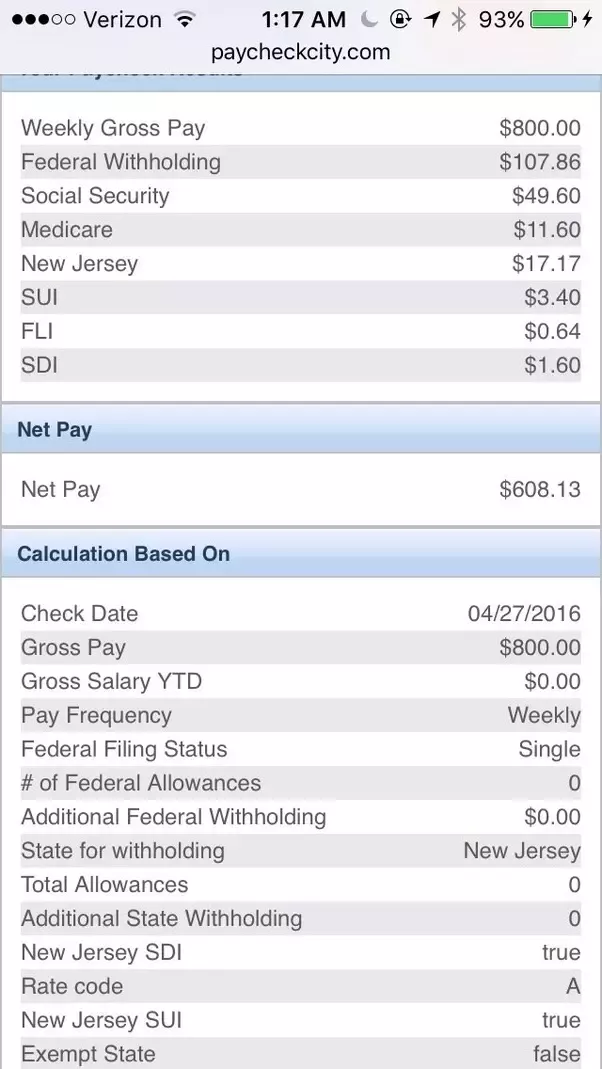

I Make 800 A Week How Much Will That Be After Taxes Quora

In 2018 The Average Family Paid More To Hospitals Than To The Federal Government In Taxes

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

State Income Tax Rates Highest Lowest 2021 Changes

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

Indiana Paycheck Calculator Smartasset

How Much Should I Set Aside For Taxes 1099

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

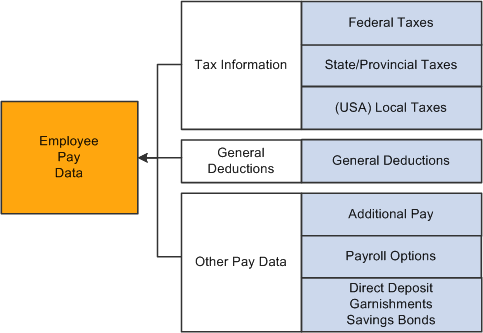

Peoplesoft Payroll For North America 9 1 Peoplebook

Middle Class Americans Face Marginal Tax Rates Near 50 In 2013 Myheritage